Choose the plan that works for you

We have flexible payment options for as little as $84 per month so you can start cooking now! Enjoy saving money while you cook at home & pay for Multo ® in instalments. It just makes good financial sense

Cart (0 items)

Free Shipping Continental US

We have flexible payment options for as little as $84 per month so you can start cooking now! Enjoy saving money while you cook at home & pay for Multo ® in instalments. It just makes good financial sense

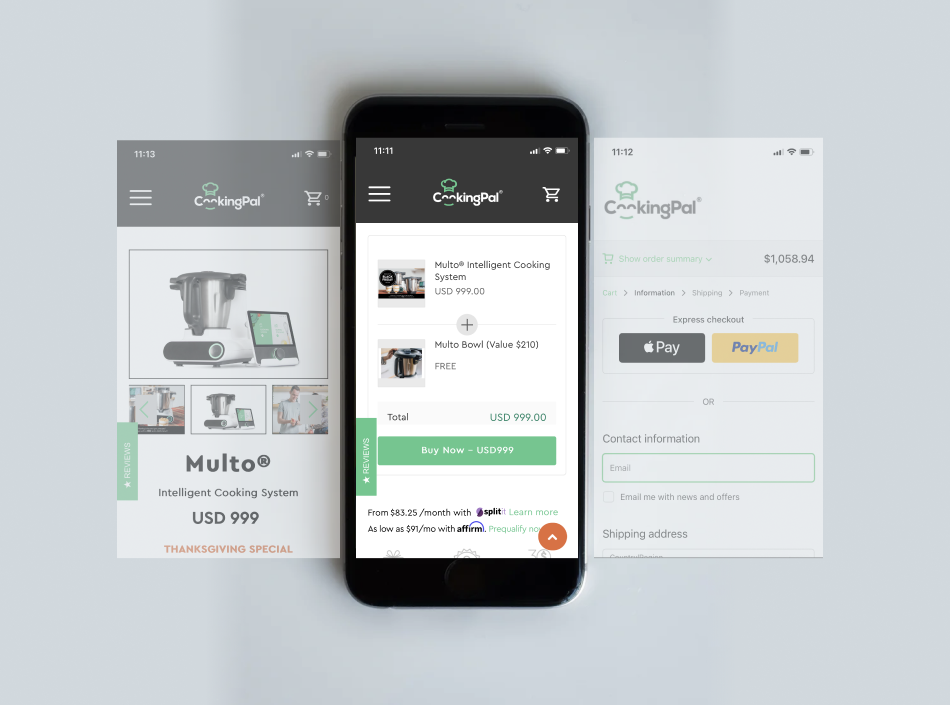

Selected your new CookingPal? Just add it to the shopping cart

Next, go to the checkout & choose the financing option that works for you

Now, select the payment schedule & installment plan for your periodic payments, & confirm your purchase

A credit card with the full purchase amount available.

Debit cards are not accepted.

Both Splitit and Affirm cater to different customer needs and expectations and allows customers to choose a flexible repayment plan that suits

them.

Splitit leverages the customer’s existing credit card, which means approval is based on their card limit at the time of purchase. With Affirm,

customers undergo a soft credit check first to establish whether they qualify for a loan.

Splitit is free for customers to use – there are no upfront fees or added interest. Affirm charges interest on the total purchase price, which can

be anywhere between 0% and 30% APR.

Affirm is a buy now pay later (BNPL) service that allows merchants to provide flexible payment plans for their customers without hidden fees or

gimmicks.

Fore more information

https://www.affirm.com

To make payments on affirm.com:

Sign in to your Affirm account.

Navigate to Pay.

Select the purchase you want.

Click Make one-time payment.

Select how much you want to pay and when.

Add or select a payment method. Click Continue.

Review the payment amount, method, and date.

Click Submit payment.

To make payments in the app:

Download the free Affirm app from the App Store (iOS) or the Google Play Store (Android).

Sign in to your account.

Navigate to Manage.

Tap on the purchase you want.

Choose the payment amount, date, and method.

Select Pay now.

You can choose the number of monthly payments that suit you and your budget from 3 to 12 monthly instalments.

Splitit enables consumers to shop more responsibly. There's no added debts, interests or hidden fees, plus they get all benefits of paying with

their existing credit card, including rewards, transaction insurance and protection against fraud.

Fore more information,

https://www.splitit.com

1. Choose Splitit at checkout

Splitit never charges any interest or late fees.*

2. Select the number of payments

You choose the number of monthly payments that suit you and your budget.

3. Enter your credit card details

Pay right on your credit card. No applications or credit checks needed.

You can choose to split your payments over 2-24 monthly installments all within your payment journey.

Your chosen card will be charged for the first installment straight away. We will take payments each month from your chosen card.

At the same time, an authorization (hold) will be taken for the full outstanding balance to guarantee your plan.

The full outstanding purchase amount is authorized to guarantee future payments.

Your first payment is taken as soon as you make your purchase and subsequent payments are automatically taken on the same date monthly

until all your payments have been made.

Order your Multo, then count down the days until Multo is cooking tasty, healthy meals at your place. While it's on the way, start planning your first mouthwatering meals from the Recipe library

Can you try the Multo challenge of replacing tempting treats each week for 8 week to potentially save $1000 USD!

1.Cut out 1 three-course family meal in a restaurant a week

Average costs in restaurant $150usd vs Multo's $45usd,

saving $105usd a week!

2. Cut out 1 Pizza delivery a week

Takeout pizza's around $20usd vs Multo's recipe costing $7,

13usd x 8 = $104usd savings

3. Skip the cafe for your smoothies 2 days a week

Average smoothie is $19usd, costing $38 per week, vs Multo's $4usd.

cut this out and save $15 x 8 = $120!

Save $1,000 in just 8 weeks!

All figures above are based on certain restaurants, stores and supermarkets, prices may vary. Actual results are not guaranteed.